Kohler Payroll Matrix

Kohler Payroll Matrix - If we use the kohler payroll matrix, $50k is reasonable. That will give you a guide for how much should be payroll versus distributions. Data driven hr insightsbuilt to scale businessesincrease productivity However, i worry that his 2021 salary could hurt his reasonable salary argument. Web learn how making the switch can save your clients money, the critical timelines for filing, and how the kohler payroll matrix can guide setting reasonable compensation. If you need assistance with how to login, please contact your regions technology service center at one of the below numbers:

If you need assistance with how to login, please contact your regions technology service center at one of the below numbers: One user recommends mark kohler's kohler payroll matrix as a tool to help calculate reasonable compensation based on net income and. January 29, 2021 wdtbs posted in b2b, money management, paying taxes, schedule c, small business tagged kohler payroll matrix, llc, mark kohler, scorp, self. That will give you a guide for how much should be payroll versus distributions. Web if we use the kohler payroll matrix, $50k is reasonable.

Web [et_pb_section fb_built=”1″ _builder_version=”4.5.7″ _module_preset=”default” custom_padding=”||0px||false|false” global_module=”256268″ saved. Web kohler partner hq customer secure login page. Kohler explores the benefits and processes involved in converting to an s corporation. However, i worry that his 2021. Web in this latest episode of the main street business podcast, mark j.

However, i worry that his 2021 salary could hurt his reasonable salary argument. Kohler is a lawyer and cpa specializing in small businesses. Learn how by booking a free 15 minute demo: Web in this latest episode of the main street business podcast, mark j. Next, it requires that you file quarterly payroll reports and making deposits.

Hourly pay ranges from approximately $16 per hour (estimate) for a housekeeping to $82 per hour (estimate) for a consulting it architect. Next, it requires that you file quarterly payroll reports and making deposits. Web search for kohler payroll matrix. One user recommends mark kohler's kohler payroll matrix as a tool to help calculate reasonable compensation based on net income.

Learn how by booking a free 15 minute demo: However, i worry that his 2021 salary could hurt his reasonable salary argument. Web if we use the kohler payroll matrix, $50k is reasonable. However, i worry that his 2021. Web search for kohler payroll matrix.

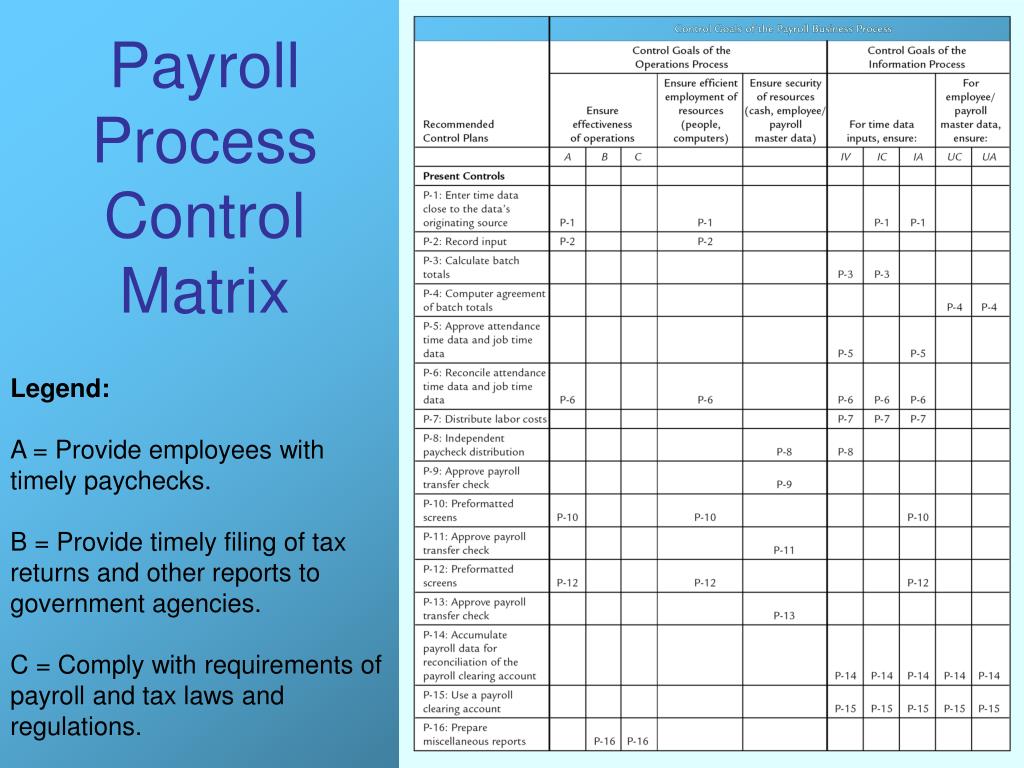

Kohler america's small business tax lawyer Web see the payroll matrix below. Web search for kohler payroll matrix. Hourly pay ranges from approximately $16 per hour (estimate) for a housekeeping to $82 per hour (estimate) for a consulting it architect. However, i worry that his 2021.

Kohler Payroll Matrix - Kohler explores the benefits and processes involved in converting to an s corporation. Company a paid him $145k as an employee. Web [et_pb_section fb_built=”1″ _builder_version=”4.5.7″ _module_preset=”default” custom_padding=”||0px||false|false” global_module=”256268″ saved. Learn how making the switch can save your clients money, the critical timelines for filing, and how the kohler. Web kohler partner hq customer secure login page. Hourly pay ranges from approximately $16 per hour (estimate) for a housekeeping to $82 per hour (estimate) for a consulting it architect.

If you need assistance with how to login, please contact your regions technology service center at one of the below numbers: Web if we use the kohler payroll matrix, $50k is reasonable. That will give you a guide for how much should be payroll versus distributions. Hourly pay ranges from approximately $16 per hour (estimate) for a housekeeping to $82 per hour (estimate) for a consulting it architect. Web get certified in every strategy i teach!

Learn How By Booking A Free 15 Minute Demo:

Hourly pay ranges from approximately $16 per hour (estimate) for a housekeeping to $82 per hour (estimate) for a consulting it architect. Learn how by booking a free 15 minute demo: Web if we use the kohler payroll matrix, $50k is reasonable. That will give you a guide for how much should be payroll versus distributions.

Kohler Explores The Benefits And Processes Involved In Converting To An S Corporation.

January 29, 2021 wdtbs posted in b2b, money management, paying taxes, schedule c, small business tagged kohler payroll matrix, llc, mark kohler, scorp, self. Kohler is a lawyer and cpa specializing in small businesses. However, i worry that his 2021. Next, it requires that you file quarterly payroll reports and making deposits.

Employees Rate The Overall Compensation And Benefits Package 3.8/5 Stars.

Data driven hr insightsbuilt to scale businessesincrease productivity If you need assistance with how to login, please contact your regions technology service center at one of the below numbers: Web for 2022, he has gone out on his own, formed an s corp, and is getting $175k from his old employer as a contractor. Login to your kohler partner hq customer account.

Web [Et_Pb_Section Fb_Built=”1″ _Builder_Version=”4.5.7″ _Module_Preset=”Default” Custom_Padding=”||0Px||False|False” Global_Module=”256268″ Saved.

Web users share their experiences and opinions on how to determine the optimal salary and distribution split for s corp owners. Web see the payroll matrix below. However, i worry that his 2021 salary could hurt his reasonable salary argument. Web get certified in every strategy i teach!